Importance of an Energy Study

Energy is the key that allows businesses to accomplish great things. It powers hospitals, manufacturing, schools, and everything in between. However, the cost of this power can hinder how much a business can grow if it’s not controlled. By knowing the basics of energy procurement, you can make informed decisions to reduce your energy costs.

Risk Tolerance

Determining your risk tolerance is extremely important in regards to energy procurement as it lays the foundation of your purchasing strategy. Are you comfortable watching the market in order to try to get a lower rate, or do you need to budget yearly costs based on a flat energy price? The former gives you an opportunity to lower your rates, but you can also get hit with unexpected rate increases while the latter gives you price stability, but the downside is that you might not be able to take advantage of lower rates when they become available. After consideration, you may even decide to use a hybrid model that combines the two options.

Pricing Strategies

Once you understand your energy procurement risk tolerance, you can start thinking about your pricing strategy. While there are multitudes of complex purchasing strategies, the four examples below provide base information to help you make the best decisions for your business.

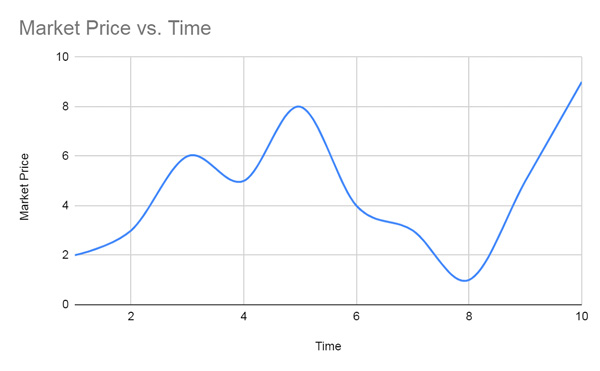

Index Pricing

The index pricing strategy is the riskiest procurement strategy because your energy cost is tied directly to the market. When prices go down, you pay less. When prices go up, you pay more.

Supply shortages, climate initiatives, and even the weather can have an effect on what market prices are for any given day or month.

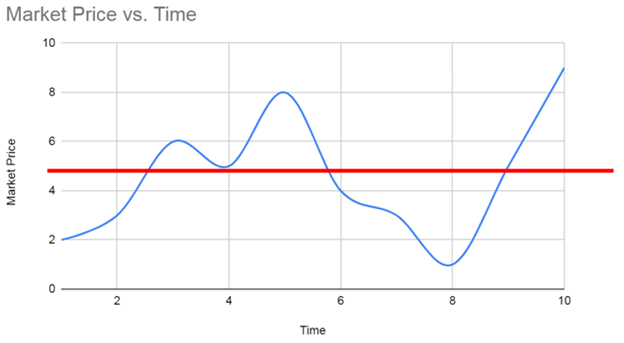

Fixed Price

The fixed price strategy allows you to predict your energy costs and is an effective option for setting product prices for the manufacturing sector.

The red line on the chart indicates the price that you will pay regardless of what happens in the market. You are protected from higher rates, but you can’t take advantage of the rates if they are lower.

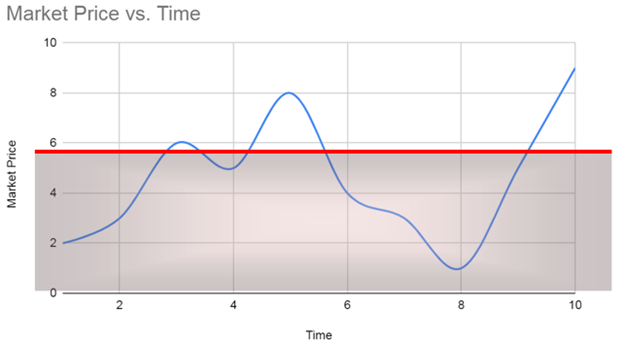

Cap Pricing

The cap strategy gives you the opportunity to combine index pricing with fixed pricing.

By using this strategy, you will never pay prices above the red line while paying market rates for prices below your “cap” price. Typically the cap price will be above what you could get for a fixed price due to your energy provider taking on additional market risk.

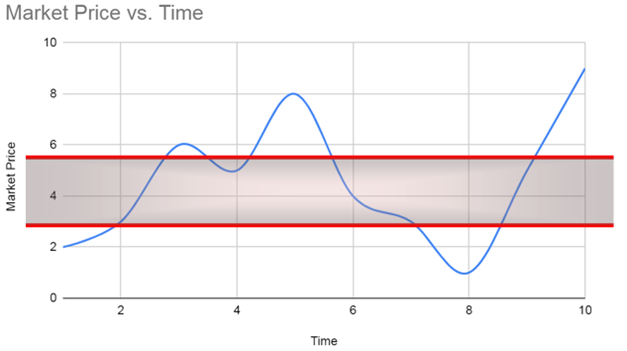

Collar Pricing

The collar strategy is another hybrid model that incorporates fixed pricing in the form of a cap, as well as a floor.

The cap remains the highest rate that you would pay while the floor exists as the lowest rate you would pay. Everything in between the cap and floor is exercised as a market rate.

Use a Consultant

You’ve determined your risk tolerance and your preferred pricing method. Now what?

In order to put your strategy into action, there is a lot of work that needs done behind the scenes to connect you to an energy provider that can give you the best rates based on your choices. This is where Tenergy LLC comes into play. We will analyze your energy bills and work with you to get the best rate possible.

Best of all, this service is FREE! Give us a call today! Save Energy. Cut Emissions. Save Money